Sba commercial loan calculator

As part of our commitment to the growth of small businesses nationwide US. Small Business Administration SBA Loans Trust your business to a Preferred SBA Lender.

2

The maximum loan amount is 5 million.

. To see the total interest charged over time for any type of commercial loan visit our calculator on this page and look at the Total Interest under the Payment Summary chart after inputting your. If you want a basic working capital loan and youre not in a hurry for example youll probably just want to stick to an SBA 7a loan. Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied we have a commercial mortgage calculator for each scenario to give you the most accurate estimates.

SBA 7a Loan Amounts Maturity Interest Rates and Fees. SBA 7a Rates. Funds can be used to cover working capital equipment purchases and.

The 599 interest rate applies to the US. SBA 7a Loan Calculator. This situation isnt uncommon.

Host Main Indexes on Your Site Features. In order to get approved for an SBA 7a loan youll need to prove that your plans for the funds are appropriate. How much money will it take to start your small business.

Todays commercial loan rates can average between 450 and 1619 depending on the loan product. View todays average commercial loan rates. Bank Business Checking account.

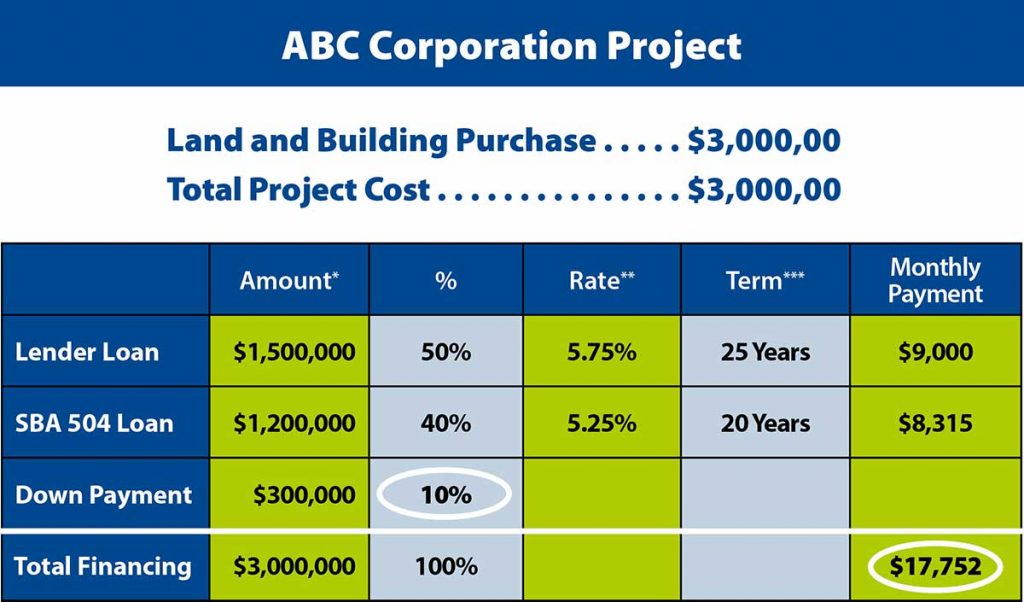

Calculate the startup costs for your small business so you can request funding attract investors and estimate when youll turn a profit. SBA Loan Healthcare Banking Paycheck Protection Program Loan Forgiveness Paycheck. SBA 504 Loan - The SBA 504 loan program starts with a conventional fixed-rate first mortgage which is typically made by a.

The difference between the two is that a commercial loan appraisal can take up to 30 days longer than a traditional mortgage appraisal. And if youre planning an intensive real estate project you may want an SBA 504 loan. SBA 504 Loan Rates.

Calculate loan payments with the Signature Personal Loan Calculator from Fifth Third Bank. If you have an SBA 7a loan offer use the SBA loan calculator below to get estimates on everything you need to know to make an informed. Use our calculator to find out which option might make the most sense for you.

When your small business is looking to grow or expand SBA loans can have many benefits. The SBA 7a loan might be right for your business so we want to make sure you have all of the information you need to make a decision. These loans require only a 10 percent down payment by the small business owner and funding amounts range from 125000 to 20 million.

The interest rate will tell you a lot but to fully understand the cost of an SBA loan youll need to have more information including the APR and the total cost of borrowing. Make multiple equipment purchases with one loan from manufacturing to commercial vehicles. With both a commercial loan and a home mortgage loan the appraisal is an important part of the approval process.

Bank is proud to be an SBA Preferred Lender specializing in providing Small Business Administration SBA loans. Bank Quick Loan secured by all business assets for loan terms from 49 to 60 months for credit qualified applicants. Use of the SBA 7a Loan.

If you need less money but you need it fast an SBA Express loan might be more your speed. SBA 7a Loan - The SBA 7a program is a 25-year fully-amortized first mortgage loan program with a floating rate tied to the Prime Rate. The interest paid on a commercial real estate loan will depend on the interest rate charged the length of the term and the amortization schedule.

While the specific allowable uses depend on the amount you want to borrow you can generally use SBA 7a funds for operational expenses refinancing certain high-cost debts hiring employees purchasing new inventory or equipment supporting. FINANCING Asset-Based Lending Commercial Lending Equipment Financing Leasing Commercial Real Estate Finance Convenience Retail Fuel Finance McDonalds Lending Restaurant. SBA 7a loans are a flexible form of business funding backed by the US.

The SBA offers a wealth of information on. Bank With Informed Decisions. Borrow funds and calculate monthly payments with our simple tool.

1 out of 6 SBA 7a loans issued from 2006 through 2015 werent paid back with the average failing loan taking close to five years to reach the default status. SouthState offers lines of credit specifically for commercial business to provide the flexibility to keep a consistent cash flow. It is the most common type of SBA loan.

Disclosed rate reflects 050 discount based on automatic monthly payments from a US. The SBA 7a program offers several loan options ranging up to 5 million with terms that extend to 25 years. Fast and easy set up.

Loan Payment Calculator. Loan amount interest rate loan term and collateral affect your monthly mortgage payment and the total cost of the loan. An SBA 504 loan is commercial real estate financing for owner-occupied properties.

Small Business Administration SBA. The loan program provides small businesses with low-interest loans of up to 5. This page includes the details of the SBA 7a loan terms and rates as well as specifics about loan amounts and maturity ratesAlso if youre making an SBA loan checklist you might.

Business Loan Calculator Small Business Trends

What Is A Business Loan Calculator And Is It Helpful Fora Financial Blog

Sba Loan Calculator Estimate Payments Lendingtree

Spedco Sba Loan Calculator Amazon Com Appstore For Android

More Economic Relief For Sba Borrowers The Sba Will Pay For Your Loan Payments For Up To Five Months Frost Brown Todd Full Service Law Firm

Spedco Sba Loan Calculator Amazon Com Appstore For Android

Business Loan Rates In 2021 Sba Loans And More Finder Com

Sba 504 Loan Calculator Free Loan Calculator Tmc Financing

Business Loan Calculators Estimate Your Payments Lendio

Sba Loan Calculator

Sample Project California Statewide Cdc

.png)

Business Loan Calculator Find The Best Loan For Your Small Business

Can I Sell My Business If I Have An Sba Loan Viking Mergers

What Is The Difference Between The Sba 504 Loan And The Sba 7a Loan Dakota Business Lending

Commercial Loan Calculators Monthly Payment Refinance Dscr Cap Rate Noi Calculators

Startup And Small Business Loan Calculator Lendio

Small Business Loan Calculator Td Bank